This Week In Review: July 11 – July 16

And the hits just keep on comin’

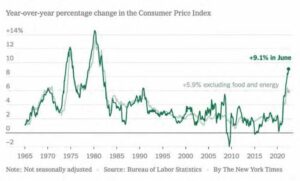

Consumer price index (CPI) and producer price index (PPI) numbers for June were released

last week — and the data’s not pretty. CPI came in at a new 40-year record high of 9.1%, 50

basis points higher than in May. Meanwhile, PPI jumped 11.3% over the past 12 months.

The latest CPI and PPI readings make it obvious inflation isn’t showing signs of peaking

yet, and any conversation about the “worst is behind us” may be premature. With inflation

heading in the wrong direction, we’ve all but cemented a 75-basis-point (0.75%) interest rate

hike at the Federal Reserve’s meeting later this month. And it wouldn’t be surprising to see a

rate increase of a full 1% from the Fed.

That’s a disappointing thought for markets, which had hoped for softer inflation data to

encourage the Fed to pause its rate-raising plans in September. But the latest readings

dashed those hopes, and markets ended another week down.

The market seems to be anticipating a couple of things. The first appears to be a fed funds

rate of 3.25% to 3.5% by year-end. Anything above that level will be a bad surprise. Second,

the market also seems to be anticipating a mild recession. The yield curve continued to invert

last week, with the 10-year Treasury curve below the two-year note. (Remember, an inverted

yield curve doesn’t always signal a recession, but every recession has been preceded by an

inverted yield curve.)

What the market has not appeared to come to grips with is how much earnings will be

impacted by ongoing high inflation. We got a taste of the pain late last week, as JP Morgan

missed on earnings and announced it was stopping its stock buyback program. Why is this

significant? Think about it: If you think your stock will go up, you buy. If you think it will drop,

you stop buying. It’s not an auspicious beginning for the earnings season.

One of the only bright spots for consumers: Oil (and by extension, gas prices) is on its way

down. While that’s good for our wallets, energy stocks pulled markets down last week as

international oil prices fell to levels we haven’t seen since before Russia invaded Ukraine. And

although PPI was high, some prices fell sharply in the past few weeks, including commodities

like lumber.

In short, current economic data is a mixed bag — and has everyone scratching their heads

about whether we’re heading for a recession and how long it will last. We should know if

we are officially in a recession later this month when the first reading of second-quarter

gross domestic product (GDP) is released. While we wait, it’s likely volatility will remain high

and markets will continue to underwhelm. If the up-and-down is making you nervous, we

recommend meeting with your financial professional to reassess your risk tolerance and

review your portfolio.

Coming This Week:

• Has there been a shift in the housing market? Lots of housing data will tell the story this

week. Building permits and housing starts will be released Tuesday. The latest existing home

sales numbers will come out Wednesday, and the forecast is for existing home sales to drop

from 5.41 million in May to 5.38 million in June.

• Other than that, it should be a relatively quiet week data-wise. Markets will be looking ahead

to the week of July 25, when the Fed is scheduled to meet again.

Thrive Capital Management, LLC (\"TCM\") is a registered investment advisor (“RIA”) with the U.S. Securities and Exchange Commission. Registration does not denote any level of skill or qualification. Insurance products and services are offered through Thrive Financial Services (“TFS”). TCM and TFS (collectively, “Thrive”) are affiliated companies. This material is provided for informational purposes only. Opinions expressed herein are solely those of Thrive. None of the information contained in this document is intended to offer personalized investment advice and does not constitute an offer to sell or solicit any offer to buy a security or any insurance product and is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual\'s situation. The information contained herein has been obtained from sources believed to be reliable but accuracy and completeness cannot be guaranteed by Thrive.