SERVICES

* Denotes that you are leaving this website and will be redirected to ThriveCapitalManagement.com

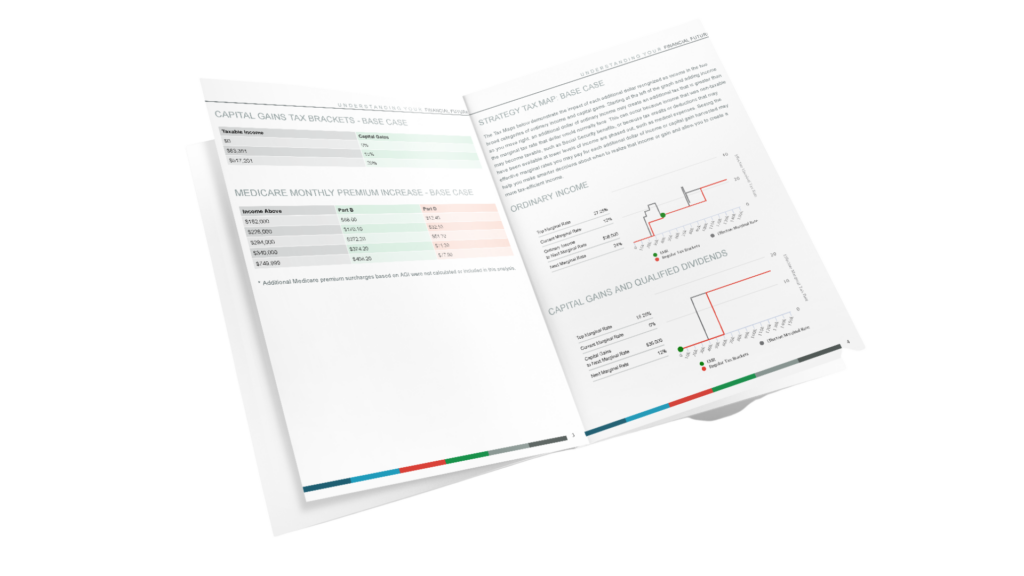

Advanced Tax Planning

Perhaps the most impactful piece of retirement planning is determining your current and future tax liability and developing strategies to minimize the amount of taxes you pay in retirement. Tax planning can have a large impact on the amount of wealth you will be able to transfer to your legacy. We will help ensure that your retirement plan is tailored to utilize both tax-advantaged and taxable products to help certify you and your heirs are maximizing wealth for generations to come.

Thrive employs technology to help elevate its practice to include comprehensive tax planning as part of an overall plan. This is just one element that allows us to assist you with your needs.

Tax Planning Services

- Roth IRA conversion analysis

- Form 1040 tax-optimization reports

- Personalized tax-reduction reports

- Year-end tax filing services

Get Your Roadmap to Thrive™

When you meet with one of our dedicated financial advisors, you will get a custom financial strategy that suits your needs.

We Specialize in Retirement Planning and Do Our Best Work With:

Aged 55+

Retirement investors age 50+ who are retired or close to it.

$250,000+

Diligent savers with investments over $250,000. (Excluding real estate.)

Guidance

People who value professional help because retirement is too important.